Accounting Chapter 10 Teacher Notes

Recording Adjusting and Closing Entries for a Service BusinessTerms and Concepts:

- Permanent accounts: carry balances from one fiscal period to the next

- Temporary accounts: are zeroed out at the end of each accounting period to prepare them for the next accounting period.

- Net Income = Revenue - Expenses

- If you leave a balance in an expense account, you will under-report income in the next reporting period..

- If you leave a balance in a revenue account (sales), you will over-report income.

- Closing entries: are made in the Journal to zero out temporary accounts.

- The Income Summary account is used to reverse the balances of the revenue and expense accounts.

- Post-closing Trial Balance: prepared after all adjusting and closing entries have been posted to the General Legder to ensure DEBITs and CREDITs equal.

- Include only accounts that have balances (permanent accounts).

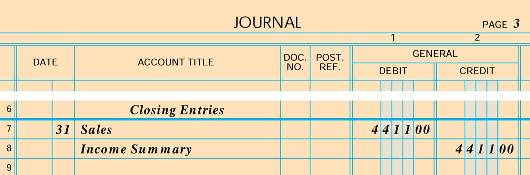

Closing Entries for Encore Music

- Close the sales account (income statement accounts with credit balances)

- DEBIT the sales account and CREDIT the Income Summary Account

- DEBIT the sales account and CREDIT the Income Summary Account

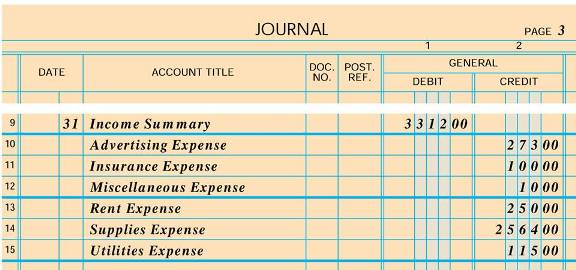

- Close the expense accounts (income statement accounts with debit balances)

- DEBIT the Income Summary Account and CREDIT the expense accounts

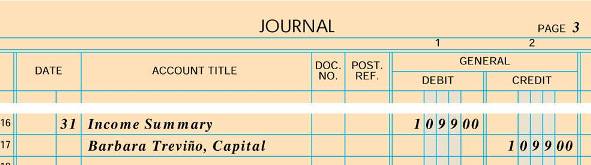

- Record net income or loss in the owner's capital account and close the Income Summary account.

- If you had a Net Income (revenue > expenses), the Income Summary account will have a credit balance.

- DEBIT Income Summary and CREDIT the Capital account.

- This increases Owner's Equity which has a normal CREDIT balance.

- If you had a Net Loss (revenue < expenses), the Income Summary account will have a debit balance.

- DEBIT Owner's Equity and CREDIT the Income Summary account.

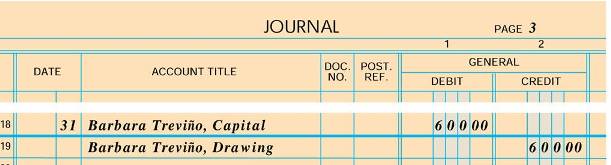

- Close the owner's drawing account.

- DEBIT the Capital account and CREDIT the Drawing account.

- This decreases Owner's Equity.

Note: Because you DEBIT the credit balance of sales to the Income Summary account, and CREDIT the balance of expenses to the same account, the balance in the Income Summary account will equal Net Income or Loss from the Worksheet.

You don't need to zero out the Net Income or Loss amount because it is already zeroed on the worksheet (recorded as a CREDIT to the Balance Sheet and a DEBIT to the Income Statement).

Accounting Cycle for a Service Business

- Analyze transactions

- check source documents (receipts, invoices, etc.) for accuracy

- Journalize

- record all transactions in the Journal

- Post

- post all Journal transactions to the General Legder

- Prepare a worksheet

- Trail Balance

- Adjustments

- Extend Balance Sheet and Income Summary accounts

- Prepare financial statements

- Balance Sheet

- Income Statement

- Journalize adjusting entries and closing entries from the worksheet

- Post adjusting entries and closing entries

- Prepare the post-closing trial balance